January 22, 2026

Birch Lake Insights: Is the Trucking Industry Ready to Roll? Rebound Signals Amid Regulatory Shifts

By Matt Slavik

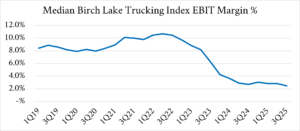

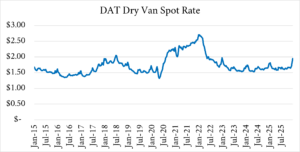

The transportation and logistics sector has endured one of its most protracted downturns since the post-COVID inventory glut peaked in early 2022, with spot linehaul rates (excluding fuel surcharges) plummeting over 40% from their 2021 highs and stabilizing at levels reminiscent of pre-pandemic norms, according to DAT data. Operating margins for publicly traded truckload (TL) carriers have compressed to a median of just 2.5% versus a low of 7.9% during the previous downturn in 2019-2020[1].

This extended freight recession, which is now stretching into its fourth year, has defied the typical two- to three-year cycles driven by supply-demand imbalances, exacerbated by overlapping headwinds including post-pandemic retailer inventory destocking, sluggish manufacturing (with ISM indices hovering around 48-50 since mid-2022), tariff-induced import shocks during 2025, and rising operational costs like diesel (up 15% year-over-year from the third quarter of 2024) and driver wages (averaging 5% to 7% annual increases). Yet, as we enter 2026, converging signals suggest a potential bottom formation, particularly if regulatory enforcement under the Trump administration accelerates capacity attrition, potentially tightening the market by 8% to 10% in the over-the-road (OTR) segment alone.

Understanding the Trucking Industry Cycle

Historically, trucking cycles hinge on capacity dynamics: excess supply enters during rate booms, only to exit via bankruptcies and consolidations in downturns, recalibrating the market. The fragmented nature of the trucking industry paired with low barriers to entry make it prone to rapid capacity swings as capacity enters and exits the industry. The 2022-2025 period witnessed notable failures such as Yellow’s liquidation, which idled 30,000 unionized workers and liquidated assets amid high leverage from prior acquisitions during a difficult operating environment.

These events trimmed capacity modestly, but not enough to spark a rebound, as new entrants and underutilized fleets persisted amid weak demand. However, recent data suggests the industry has stabilized and has the potential to see a meaningful rebound during 2026. Key datapoints that indicate an optimistic outlook for 2026 include: a year-end surge in dry van spot rates, used truck prices rebounding 11% from 2024 lows, and new truck orders languishing 20% to 30% below replacement levels, signaling deferred capex and potential fleet contraction.

Regulatory Changes Could Trim Capacity, Accelerate a Rebound

Among the most pivotal signals for 2026 is the Trump administration’s aggressive regulatory push, which could catalyze a supply-side inflection unlike the demand-driven recoveries of past cycles. The Department of Transportation (DOT) and Federal Motor Carrier Safety Administration (FMCSA) have ramped up enforcement. Among the most meaningful proposals:

- Overhauling electronic logging device (ELD) vetting to close loopholes exploited for hours-of-service violations;

- Proposing the closure of thousands of substandard truck driving schools;

- Threatening to withhold federal highway funding from states failing to tighten compliance standards.

These moves build on the non-domiciled commercial driver’s license restrictions, where FMCSA estimates 200,000 such licenses could be impacted, which potentially reduces OTR capacity by ~6% based on a 3.5 million OTR driver base, with further upside if the true OTR driver base sits below the 3.5 million that some have recently argued is the case. Despite a court stay on the non-dom rule, many states have paused issuances, creating de facto barriers to new entrants, particularly from cross-border operations.

This multipronged regulatory approach to the industry has the potential to significantly limit industry supply, with enforcement key to materializing impacts; if fully implemented, it could sideline as much as 10% to 15% of marginal capacity in fragmented segments like dry van TL, where utilization rates have dipped below 85%. This regulatory-driven tightening aligns with historical precedents, such as the 2018 ELD mandate that temporarily boosted rates 20% to 30%, but with broader scope here, potentially amplifying effects amid already low new truck orders (down 25% year-over-year from the third quarter of 2024).

Policy and Economic Factors Could Boost Demand

Complementing these supply constraints, anecdotal evidence from earnings calls points to onshoring accelerations, driven by federal incentives and to avoid the steep tariffs that have been implemented. This re-shoring, combined with nearshoring to Mexico (up 15% in cross-border volumes since 2023), could drive secular demand tailwinds, especially as global supply chains diversify away from China.

While the initial “Liberation Day” tariff announcements had a very negative shock to US import volumes as many tried to wait out what was believed to be temporary tariffs, as we approach the one-year anniversary, the new tariff regime has begun to normalize itself within the system. Business surveys indicate declining anxiety, with tariff concerns trending down 20% in executive polls over the past six months. This normalization could stabilize import flows, further supported by resilient consumer spending and normalized retail inventory levels.

Interpreting Multiple Traffic Signals

Of course, every green light we watch for could also turn red: a sharper-than-expected economic slowdown could exacerbate demand weakness, while uneven regulatory enforcement, which will be potentially challenged in courts, might delay capacity exits. Fed rate cuts (three projected for 2026 by many economists) and the revival of bonus depreciation via pending legislation could incentivize capex, but if tariffs escalate further, they might suppress imports more than anticipated. Still, the confluence of stabilizing metrics and policy-driven supply discipline positions the sector for a potential upturn. For asset-heavy players this could translate to an accelerating rebound of industry rates and significantly improved operating conditions.

Matt Slavik joined Birch Lake in 2023 after successfully executing new investments and strategic and operational initiatives at portfolio companies owned by Equity Group Investments, the private investment firm founded by Sam Zell, and at Riverarch Equity Partners, a middle-market private equity firm. At Birch Lake, Matt uses his private capital and advisory experience to identify, evaluate, and help execute new investment opportunities, monitor current portfolio companies, and partner with management teams on advisory engagements to develop and implement strategic solutions and value creation initiatives.

[1] Birch Lake Trucking Index, which includes KNX, SNDR, JBHT, WERN, MRTN, PAMT, HTLD, and CVLG.